As a financial planner, one of the questions I hear most is, “How much money do I need to retire?” While there are many calculations and rules of thumb financial professionals can use to answer this question, the truth is this number is different for everyone–and it can change for many reasons once you’re retired.

When it comes to estimating your retirement expenses, one of the biggest unknowns is the cost of healthcare. Depending on your lifestyle, how long you live, and a multitude of other factors, you may spend well into the six figures on healthcare after you stop working. In fact, the average 65-year-old retired couple may need about $315,000 to cover healthcare expenses, according to a 2022 Fidelity report.

For most retirees, healthcare is one of the largest–if not the largest–expenses in retirement. So, the last thing you want is for your healthcare costs to unexpectedly rise, especially when you can prevent it. That’s why it’s important to understand what IRMAA is, as well as the steps you can take to avoid it.

What Is IRMAA?

IRMAA, short for income-related monthly adjustment amount, is a surcharge Medicare beneficiaries must pay each month if their income exceeds a certain threshold.

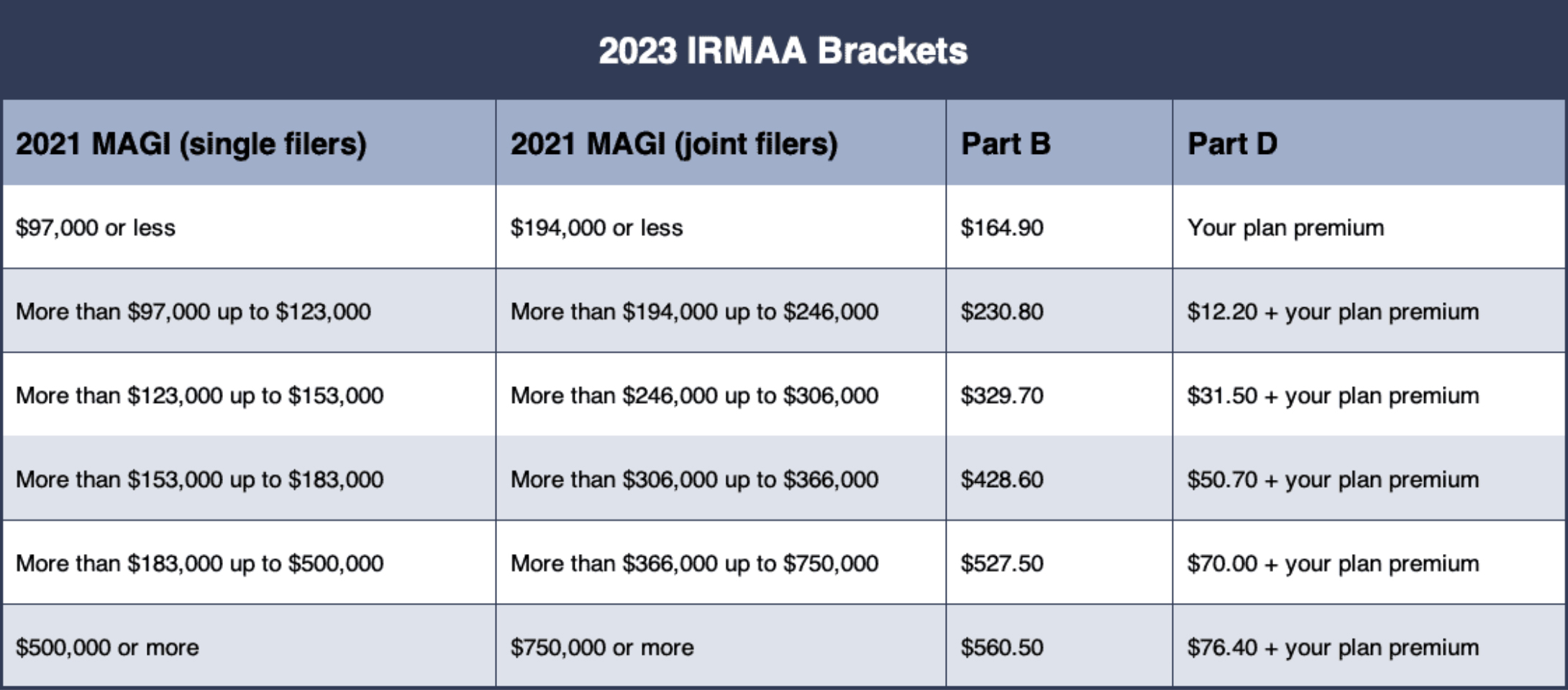

To determine if you’re subject to IRMAA charges, the Social Security Administration uses your modified adjusted gross income (MAGI) from your tax return two years ago. For example, the 2023 income brackets for IRMAA apply to the adjusted gross income you reported in 2021.

In 2023, the standard Part B monthly premium is $164.90. Those subject to IRMAA may see their Part B premiums increase by as much as $395.60 per month. Furthermore, IRMAA can increase Medicare Part D premiums by as much as $76.40.

Thus, IRMAA can significantly increase your healthcare expenses if you make too much money. While there are ways to appeal IRMAA if you don’t think it applies to you, the easiest way to avoid it is to keep your retirement income below the threshold.

How Is IRMAA Calculated?

The Social Security Administration uses its own MAGI calculation to determine if you must pay IRMAA. To calculate this number yourself, locate your Adjusted Gross Income (AGI) on your tax return. Then, add the following:

- Tax-exempt interest that you’ve earned or accrued (e.g., municipal bond interest).

- Interest from U.S. Savings Bonds you used to pay for higher education.

- Any income you earned while living abroad that was excluded from your gross income.

- Income from Puerto Rico, American Samoa, Guam, and/or Northern Mariana Islands, which is not otherwise included in AGI.

The total amount is your Medicare-specific MAGI. Below are the income brackets for 2023. These income thresholds generally change each year based on the inflation rate.

Who Pays IRMAA?

If you owe IRMAA, the Social Security Administration will let you know by sending you a letter. Here’s how it works:

- When you first enroll in Medicare, you pay the standard Part B and D premiums.

- If your income is high enough to trigger IRMAA, the Social Security Administration will send you a pre-determination notice.

- If you believe the information that the SSA sends you is inaccurate, you have 10 days to contact them to dispute the notice.

- Otherwise, the SSA will send you an initial determination notice within a few weeks of sending the pre-determination notice.

The determination notice has most of the same information as the pre-determination notice but also outlines an appeals process. If you decide to appeal the IRMAA decision, you must file Form SSA-44 and show that either your tax return was out of date or inaccurate or that your income has recently decreased because of a life-changing event. Examples may include:

- Death of a spouse

- Divorce or annulment

- Marriage

- Work stoppage or reduction

If you are subject to IRMAA and have your Medicare Part B and D premiums deducted from your Social Security checks, you don’t need to take any action to pay the surcharge. If you pay your premiums separately, you’ll receive a bill to pay IRMAA.

How to Avoid the Medicare Surcharge

Keeping your income below the IRMAA threshold is the easiest way to avoid the Medicare surcharge.

This may be challenging if you need to make a large withdrawal for an unexpected expense or in years when you must take required minimum distributions (RMDs). Fortunately, there are a variety of tax planning strategies that can help lower your Medicare-specific MAGI.

Below are a few examples of strategies that can help you avoid IRMAA.

Give Strategically

- Donating cash to a donor-advised fund (DAF) – A DAF allows you to make a lump-sum charitable donation and take the deduction in the current tax year. An additional benefit is that you don’t have to decide where your donation goes right away. Instead, you can take your time and direct your donations in the years that follow.

- Donating appreciated securities directly to a charity or to a DAF – This strategy allows you to avoid the capital gains taxes you’d otherwise pay if you sold the securities outright. Since capital gains are included in the MAGI calculation, this strategy can help reduce your Medicare-specific income.

- Qualified Charitable Distributions (QCDs) – If you reach RMD age and don’t need the extra income, you can donate your RMD to charity—a tax planning strategy called a qualified charitable distribution (QCD). A QCD allows IRA owners to transfer up to $100,000 directly to charity each year. And since RMDs are included in the MAGI calculation, donating yours can help you avoid triggering the IRMAA surcharge.

Use Down Markets to Your Advantage

- Tax-loss harvesting – The IRS allows investors to offset realized capital gains with realized losses from other investments. If you have substantial losses, you may be able to completely offset your gains and potentially lower your taxable income.

- Roth conversion – Since account values typically decline in a negative market environment, so does the amount on which you’ll pay taxes when converting part or all of your traditional IRA funds to a Roth. Plus, since Roth IRAs don’t have RMDs, you can reduce your taxable income in future years.

Max Out Tax-Advantaged Accounts If You’re Still Working

- Traditional IRA or 401(k) – Contributions you make to traditional retirement accounts reduce your taxable income. You can also take advantage of catch-up contributions once you turn 50.

- Health savings account (HSA) – With an HSA, contributions, capital gains, and withdrawals are all tax-free if you use your funds for eligible healthcare expenses. And like qualified retirement accounts, you can deduct your contributions from your taxable income in most cases.

Align Financial Can Help You Plan for a Financially Secure Retirement

The transition to retirement can be exhilarating. Yet it can also be overwhelming–especially if you’re not financially prepared.

Indeed, IRMAA is just one example of the many unexpected costs you may face in retirement. Fortunately, you can minimize unnecessary expenses and make the most of your financial resources in retirement with a well-defined financial plan.

An experienced financial advisor like Align Financial can help you develop a comprehensive plan for your retirement and beyond. To see if we may be a good fit for your financial planning needs, please contact us. We’d love to hear from you.