Thanks to the recently-enacted 2017 Tax Cuts and Jobs Act, or TCJA, married taxpayers may be singing a sweet goodbye to yesteryear’s marriage penalty … that is, unless they fit into a couple of specific scenarios.

With Q4 upon us and April already looming in the distance, I’ve been having a lot of conversations with my clients as many earners are trying to get a handle on their end-of-year financial planning — which, yes, means contending with taxes.

It’s a little funny when you think about it — lots of people cite financial benefits as part of the reason they get married in the first place. (You know, along with that whole “love” thing.)

But filing jointly has historically come at a cost for some earners, due to a trick of the tax code known widely as the marriage penalty.

THE MARRIAGE PENALTY, AND HOW IT CHANGED

Before the TCJA, married couples with similar incomes would often end up paying significantly more in income tax than those who filed separately. For instance, if two single individuals each earned $150,000 in a given year, they would have each paid $41,616.25 in taxes for a total of $83,232.50 — but the increased rate for joint filing would require a payment of $87,039.00, including a “penalty” of $3,806.50.

This problem applied to lower-income earners too, by the way; even a couple who only earned $15,000 each would have ended up paying an extra $1,087.88 by filing jointly, a penalty which would obviously have a much larger impact in that scenario.

On the other hand, couples with disparate incomes could benefit from a tax bonus under the old regime. But given today’s typical marriage with dual “breadwinners,” this policy was decidedly outdated.

The TCJA was marketed and passed largely as a simplifying measure. And indeed, it has made much of the tax code less convoluted. That includes the majority of personal income tax rates for married and single filers. Instead of the complicated math of old, most of today’s earners will be taxed at the same rate regardless of whether they’re filing singly or jointly. So long, marriage penalty!

The problem is that one little word: “most.” Because for high-bracket earners, the marriage penalty is still alive and well — as it is for those planning to take significant itemized deductions.

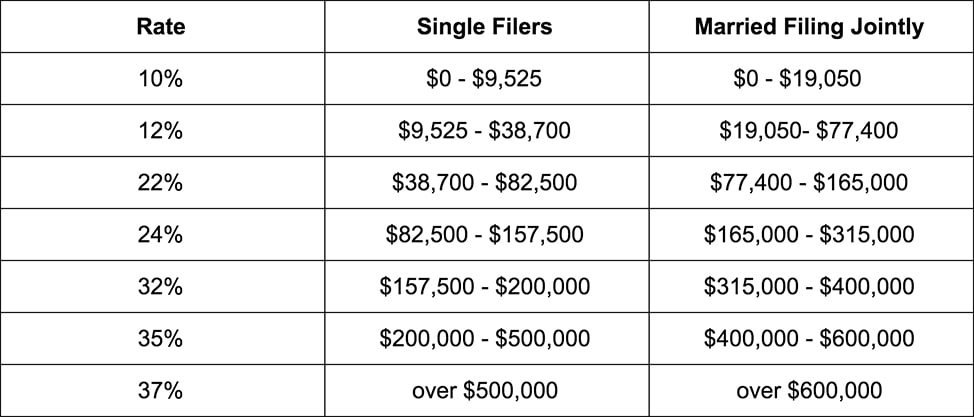

PERSONAL INCOME TAX RATES 2018

Below, you’ll find the personal income tax rates for 2018, as per the new TCJA guidelines.

As you can see, in the majority of cases, the joint filing income range is simply double that of single filers — meaning earners will be paying exactly the same amount of income tax whether or not they’ve said “I do.”

But things get a little tricky at the top bracket, where the income threshold for married folks is $600,000 and $500,000 for singles — as opposed to $300,000, the one-half amount it would be if it followed the rest of the policy’s pattern.

What it means in layman’s terms: Singles each get an extra $200,000 of wiggle room at the 35% rate, while joint filers must pay 2% more on the first combined $400,000 they make over $600,000 in taxable income. That means a marriage penalty of up to $8,000, or 2.59%, for the highest earners.

WHAT ABOUT ITEMIZED DEDUCTIONS?

Of course, the new marriage penalty on personal income tax applies only to the highest-level earners. But regardless of how much you make, there’s another tax-code trap that could affect your payment.

That’s because the TCJA limits personal itemized deductions for state and local taxes to a total of $10,000 per taxpayer per year… regardless of whether you’re filing singly or jointly.

That means a married couple can only deduct $10,000, whereas two individuals filing separately could each deduct that much, for a total of $20,000. This deduction limit works out to a maximum marriage penalty of $3,700 for top-bracket earners, with lower — but still significant — penalties for others.

WILL THE NEW MARRIAGE PENALTY AFFECT YOU?

If you will be affected by the new marriage penalty, there is one silver lining to consider: Your additional contribution, though involuntary, will help the government raise the revenue it needs to fund other TCJA tax deductions. (This may be cold comfort, we know.)

But as in all aspects of money-related life, the tax drawbacks or benefits are just one, hopefully vanishingly small, part of your marriage — and a totally overcomeable financial obstacle, even in the worst-case scenario.

For more information on the marriage penalty and whether or not it’ll have an impact on your financial planning, reach out to us today to schedule a quick chat. We’re always here to ensure you have the tools you need to align your financial goals with your plans for the future.